Itemized Deductions Checklist free printable template

Show details

Itemized Deductions Checklist Medical Expenses Some common medical expenses Doctor/Dentist Fees Life-Care Fees for Medical Psychiatric Care Drug/Alcohol Treatment Treatment School and/or Home for Cost of Guide Dogs Long-term Care Insurance Disabled Handicap Access Devices for Premiums Smoking Cessation Program Meals/Lodging Related to Cost Hospital Fees Hospital Stays Special Life Items glasses Insurance Premiums Medical Devices limbs dentures wheelchairs Prescriptions Operations...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax list of deductions form

Edit your itemized deductions list form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your list of itemized deductions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit list of tax deductions online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit list of tax write offs for llc form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out itemized tax deductions checklist form

How to fill out Itemized Deductions Checklist

01

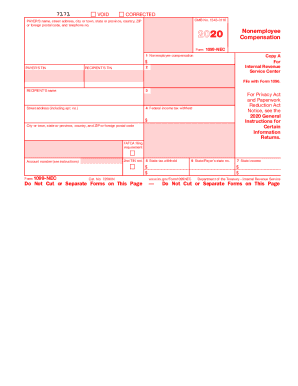

Gather your documents, including W-2s, 1099s, and receipts for expenses.

02

Identify deductible expenses such as medical bills, mortgage interest, property taxes, and charitable contributions.

03

Use the Itemized Deductions Checklist form to list each expense and the corresponding amounts.

04

Ensure that you have supporting documentation for each item listed.

05

Total your deductible expenses to see if they exceed the standard deduction for your filing status.

Who needs Itemized Deductions Checklist?

01

Taxpayers who have significant deductible expenses that exceed the standard deduction.

02

Individuals who want to maximize their tax deductions to lower taxable income.

03

Homeowners who pay mortgage interest and property taxes.

04

Charitable donors who contribute significant amounts to qualified charities.

Fill

a list of tax write offs

: Try Risk Free

People Also Ask about business tax deductions 2023

What form is itemized deductions 2022?

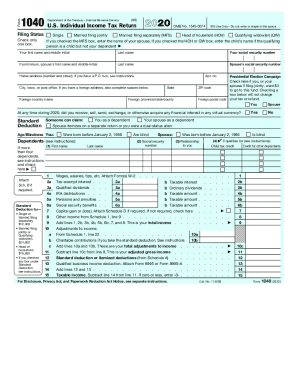

Schedule A is an IRS form used to claim itemized deductions on your tax return. You fill out and file a Schedule A at tax time and attach it to or file it electronically with your Form 1040.

What are 4 examples of deductions?

Itemized Deductions Standard deduction and itemized deductions. Deductible nonbusiness taxes. Personal Property tax. Real estate tax. Sales tax. Charitable contributions. Gambling loss. Miscellaneous expenses.

What are 4 types of deductions?

Payroll deductions fall into four different categories – pretax, post-tax, voluntary and mandatory – with some overlap in between.

What are the 5 types of itemized deductions?

You may be able to reduce your tax by itemizing deductions on Schedule A (Form 1040), Itemized Deductions. Itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses.

What form for tax deductions?

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

What are the 4 most common tax deductions?

The 5 Most Common Tax Deductions Personal Exemption. The personal exemption is one of the most common tax deductions. Standard Deduction. Another common tax deduction is the standard deduction. Charitable Contributions. Mortgage Interest. Tax-Advantaged Account Contributions.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my itemized tax deductions list in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your itemized deductions 2024 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in 2024 itemized deductions?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your checklist for business tax deductions to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the printable list of tax deductions electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tax deductions checklist printable in seconds.

What is Itemized Deductions Checklist?

The Itemized Deductions Checklist is a document that helps taxpayers list and organize expenses that can be deducted from their taxable income, instead of taking the standard deduction.

Who is required to file Itemized Deductions Checklist?

Taxpayers who have qualifying expenses that exceed the standard deduction threshold or who choose to itemize their deductions instead of taking the standard deduction are required to file this checklist.

How to fill out Itemized Deductions Checklist?

To fill out the Itemized Deductions Checklist, gather all relevant receipts and documents for deductible expenses such as medical expenses, mortgage interest, charitable contributions, and state taxes. Then, systematically list these expenses according to their categories on the checklist.

What is the purpose of Itemized Deductions Checklist?

The purpose of the Itemized Deductions Checklist is to provide a structured way for taxpayers to track and claim eligible deductions, ultimately lowering their taxable income and potentially increasing their tax refund.

What information must be reported on Itemized Deductions Checklist?

The information that must be reported includes details of deductible expenses such as medical and dental expenses, state and local taxes, mortgage interest, charitable donations, and certain unreimbursed employee expenses, along with their respective amounts.

Fill out your Itemized Deductions Checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deduction Checklist is not the form you're looking for?Search for another form here.

Keywords relevant to printable tax deduction list

Related to tax deductions of list

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.